Source Document

Any business form that provides objective and tangible proof that a transaction occurred.

Types of Documents

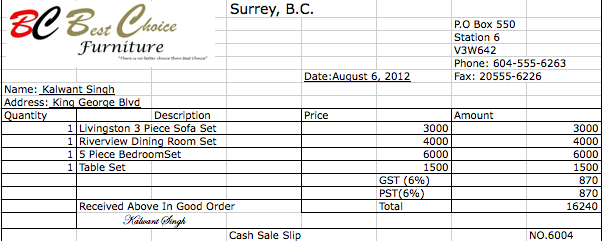

Cash Sales Slip

Prepared when a sale is made in exchange for cash

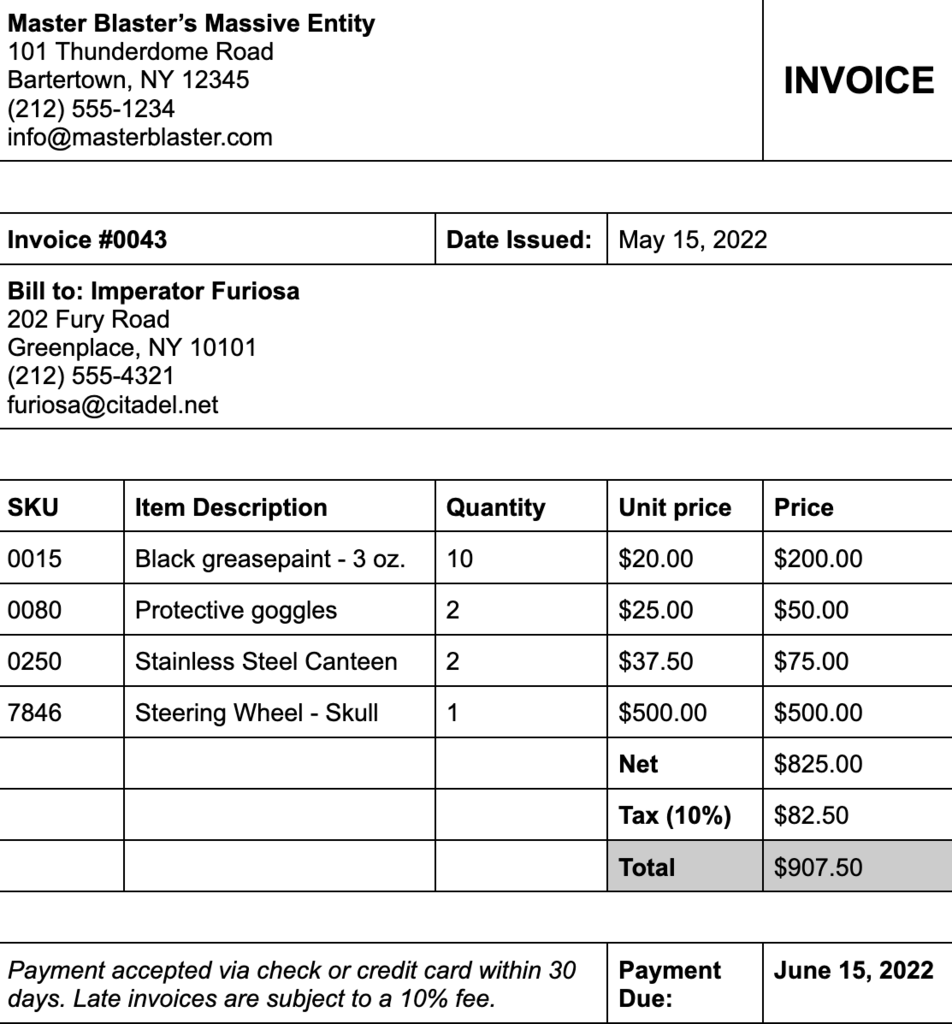

Sales Invoice

Prepared when a sale is made on account

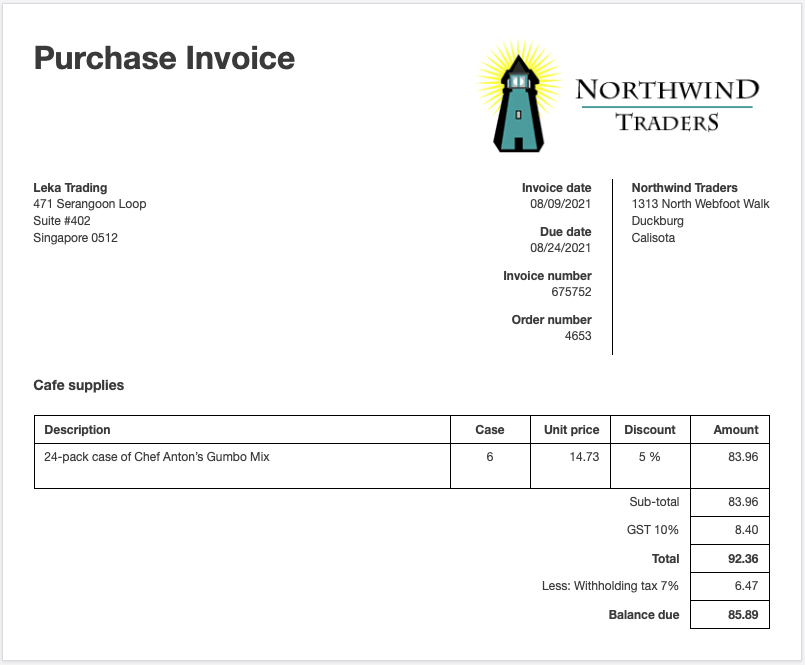

Purchase invoice

Received when items are purchased

Purchase and Sales Invoices

Copies 1 and 2 of a sales invoice are called the “purchase invoice” by the buyer. Consequently, the same source document represents a sales invoice to the “Seller” and it represents a purchase invoice to the “Buyer”

More types

Cheque Copy

Prepared when a cheque is written and sent as payment. It is a carbon copy of the cheque sent and provides proof that payment was made.

Cheque

Cash Receipts, Business cheques are composed of the cheque itself and a stub that provides details of the transaction

When a business receives a cheque in the mail; the cheque is separated from the stub and the cheque is immediately stamped with a Restrictive endorsement and deposited in the bank. The stubs are used to journalize the fact that payment was received.

Example:

“For deposit only into account #14322”

Credit Invoice

Prepared when customers return goods to us

Credit Memo

Indicates that additional funds have been placed into the company’s bank account by the bank. e.g. interest earned on a bank account

Debit Memo

Indicates that funds have been taken out of the company’s bank account by the bank. e.g. Service charges

Should Debit and Credit Memos be swapped?

Look at it from the bank’s perspective. Our money represents a liability to the bank. It owes it back to us - therefore when our bank account goes up, the bank owes us more and therefore their liability goes up; therefore credit

Security

All source documents are prenumbered and must be accounted for. This is an Internal Control procedure because it prevents theft by employees.